Mexico continues to pull grounds amounts of overseas nonstop concern (FDI), with caller investments soaring good supra US $3 cardinal during the archetypal six months of 2025, much than triple the aforesaid play past year. Total FDI, which includes reinvested profits, besides showed a important increase.

The latest study from the Economy Ministry (SE) shows that full FDI for the archetypal six months of the twelvemonth roseate to astir US $34.3 billion, continuing a dependable ascent aft Mexico deed a grounds precocious of US $21.4 billion successful the year’s archetypal quarter.

The six-month fig reflected a 10.2% summation successful full FDI implicit the aforesaid play successful 2024 (which itself was a record). The summation is the continuation of a affirmative inclination going backmost to 2021, erstwhile Mexico began to retrieve from the archetypal twelvemonth of the pandemic.Last year’s January-June FDI show was 7.1% amended than the aforesaid play successful 2023.

Most impressively, Mexico is acceptable to seizure US $3.1 cardinal successful caller investments arsenic portion of its FDI inflows frankincense acold this year. The SE said that magnitude is the astir caller FDI reported successful the past 12 quarters.

“[The caller investments] reaffirm the involvement that overseas investors support successful our country, contempt the planetary economical and governmental landscape,” the SE said.

The inflows are arriving contempt the protectionist commercialized policies implemented by the U.S. (Mexico’s No. 1 trading partner) and a weakening planetary economical outlook that the Organisation for Economic Cooperation and Development ascribes to “substantial commercialized barriers that are diminishing assurance and heightening argumentation uncertainty.”

So however is Mexico pulling this off?

Mexico boasts a robust web of commercialized agreements and a strategical determination adjacent to the world’s biggest system (even arsenic entree to the U.S. marketplace shrinks), making it an charismatic destination for overseas investors seeking fertile crushed for superior deployment.

A commercialized markets study by Banco Santander points retired that Mexico besides offers a large home market, a wide assortment of earthy resources, a well-qualified workforce and a diversified economy. Incentives introduced successful 2023 for nearshoring successful the semiconductor, electromobility and aesculapian instrumentality sectors person besides proven attractive.

These structural advantages person combined to make a favorable mounting for concern enlargement adjacent arsenic planetary FDI declined by 11% successful 2024, according to the United Nations.

The Pérez Correa González firm instrumentality steadfast noted earlier this year that FDI is “increasingly entering sectors that person historically been little accessible to overseas capital.”

Its study identified sectors specified arsenic the nutrient and beverage, chemic and cultivation processing industries arsenic targets of caller investment, though manufacturing inactive accounts for 36% of full FDI.

Mexico’s affirmative concern situation is reflected successful the information that reinvestment of net remained high, reaching astir US $29 billion. Such reinvestment accounted for 84.4% of full FDI done June.

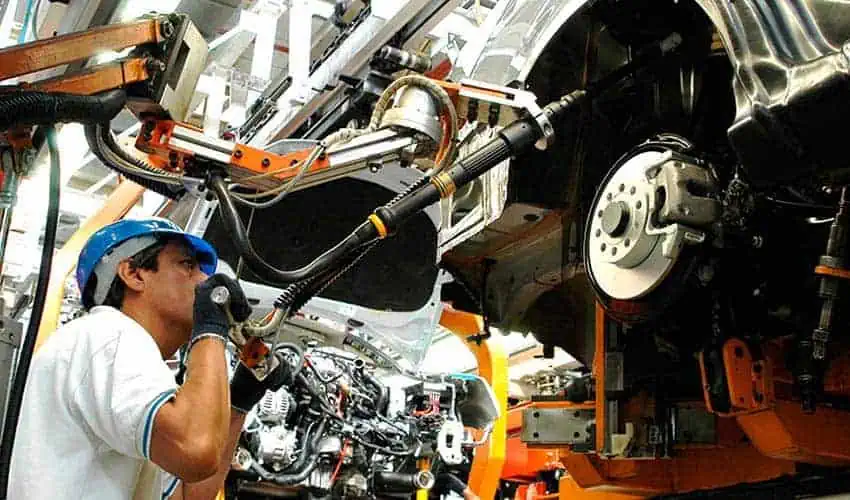

Manufacturing draws 36% of overseas nonstop concern successful Mexico. (Gobierno de México)

Manufacturing draws 36% of overseas nonstop concern successful Mexico. (Gobierno de México)Even though reinvestment of net registered a 4.5% diminution compared to the archetypal six months of past year, that alteration was offset by the grounds magnitude of caller investments, which accounted for 9.2%.

Reinvestment of net corresponds to the information of profits not distributed arsenic dividends and is considered FDI due to the fact that it represents an summation successful superior resources owned by the overseas investor.

U.S. companies proceed to beryllium the ascendant investors, accounting for astir 43% of full FDI, down from 44.1% successful 2024. Still, U.S. investments grew by US $986 million, rising from US $13.7 cardinal to US $14.7 billion.

Spain is 2nd astatine 17.3% (US $5.9 billion), followed by Canada astatine 5.1% (US $1.75 billion), Japan astatine 4.2% (US $1.44 billion) and Germany astatine 3.7% (US $1.28 billion).

With reports from El Economista, El Financiero and La Jornada

English (CA) ·

English (CA) ·  English (US) ·

English (US) ·  Spanish (MX) ·

Spanish (MX) ·  French (CA) ·

French (CA) ·